Table of Contents

- What Year Of W2 Do I Need For 2025 - Lona Thomasin

- W2W #175 - 100522 - IGN

- Defence employment conditions agreement: 7% wage increase between ...

- Call of Duty 2025 is a Black Ops 2 Sequel | Futuristic COD 2025 Title ...

- W2 Statements for 2023

- IRS Abandons W-2 Redesign for 2024

- Warbirds of WWII Kalender 2025 Kopen? | Bestel eenvoudig Online ...

- W2 - YouTube

- DoD unveils 2023-2027 CWF Strategy Implementation Plan, addresses ...

- DOD's FY 2025 Budget Focuses on Defense, People, Teamwork > U.S ...

What to Expect from the 2024 Tax Statement Release Schedule

Accessing Your Tax Statements

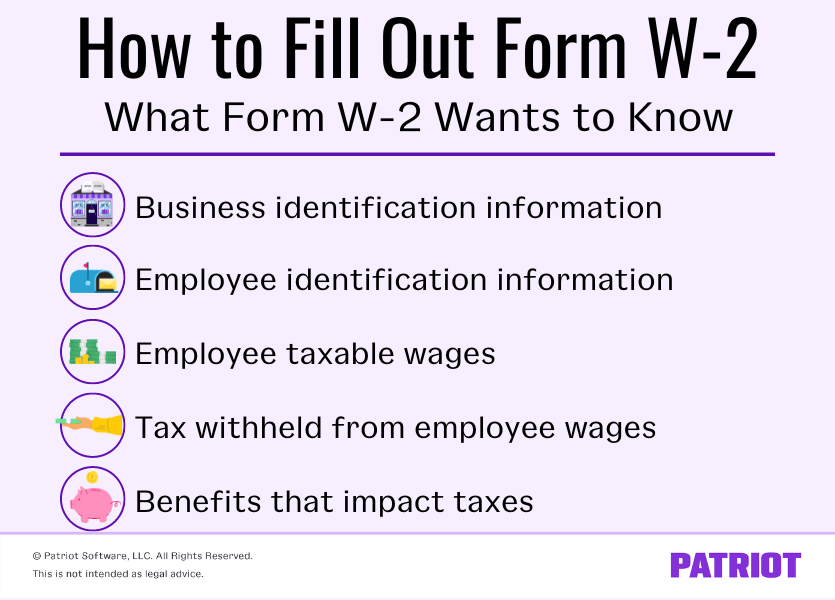

Importance of Tax Statements

Tax statements are a critical component of the tax filing process, providing individuals with the necessary information to accurately report their income and claim deductions. The DFAS issues various tax statements, including: W-2 statements, which report wages, salaries, and tips. 1099-R statements, which report retirement and annuity income. 1099-MISC statements, which report miscellaneous income. These tax statements are used to prepare and file tax returns, and it is essential to ensure that the information is accurate and complete to avoid any delays or issues with the IRS. The DFAS 2024 tax statement release schedule is now available, providing military personnel, retirees, and annuitants with the information they need to prepare for tax season. By understanding the release schedule and how to access their tax statements, individuals can ensure a smooth and efficient tax filing process. Remember to regularly check the DFAS website and your myPay account for updates and to access your tax statements as soon as they become available.Keyword: DFAS, 2024 tax statement release schedule, myPay, tax season, W-2, 1099-R, 1099-MISC